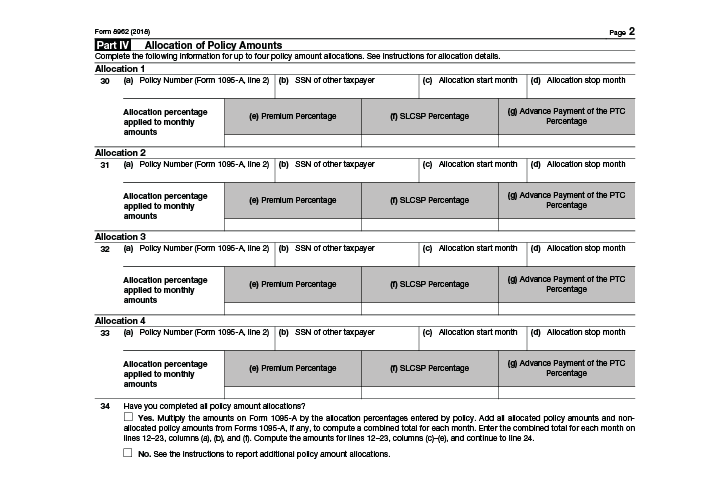

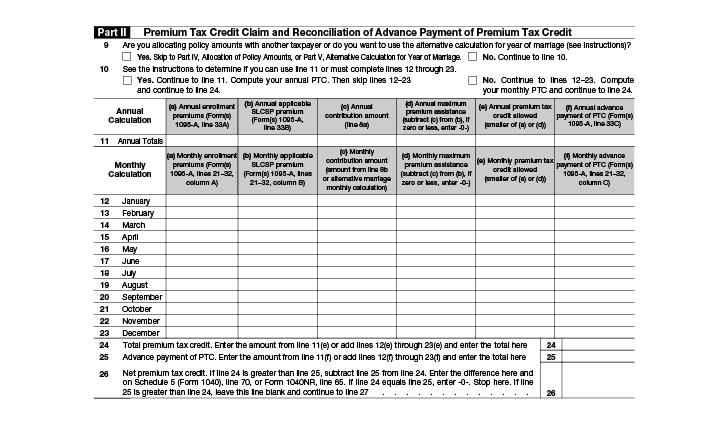

Note that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposesJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle6/30/19 · The advance payments of your tax credit that you used to offset your premium payments are listed in Part III, column C of your Form 1095A Copy these amounts into Part II, column (f) of your Form 62 Use the annual amount listed on line 33 of your Form 1095A on line 11 of your Form 62

Ez1095 Software How To Print Form 1095 C And 1094 C

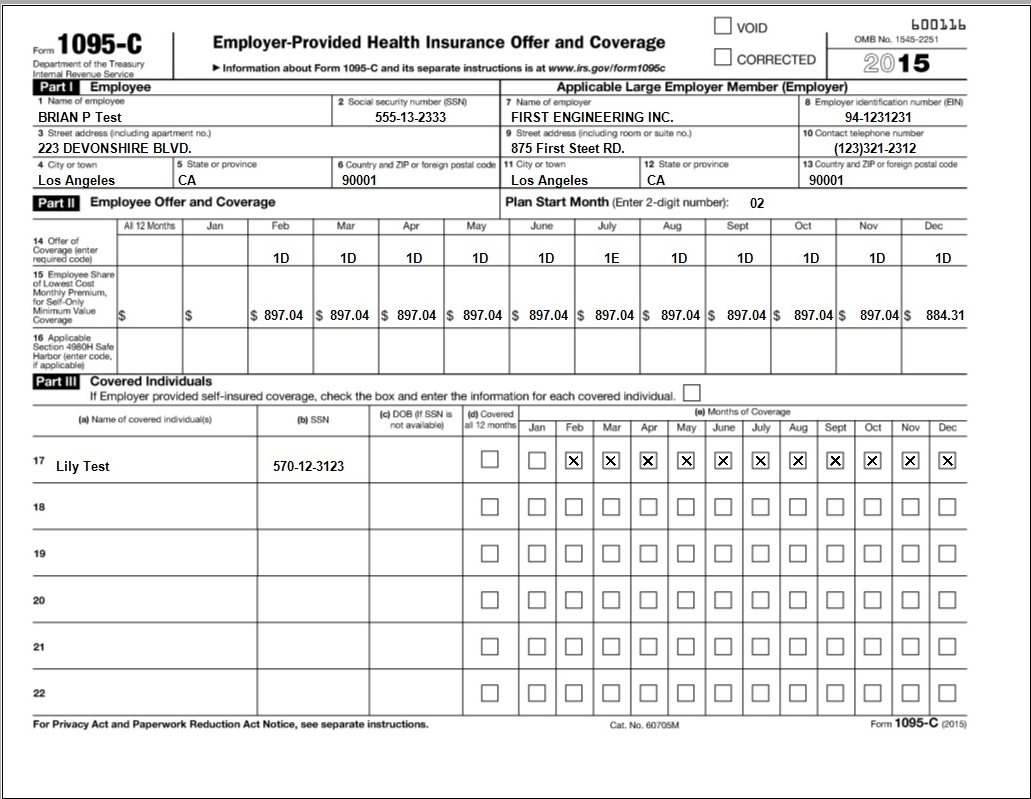

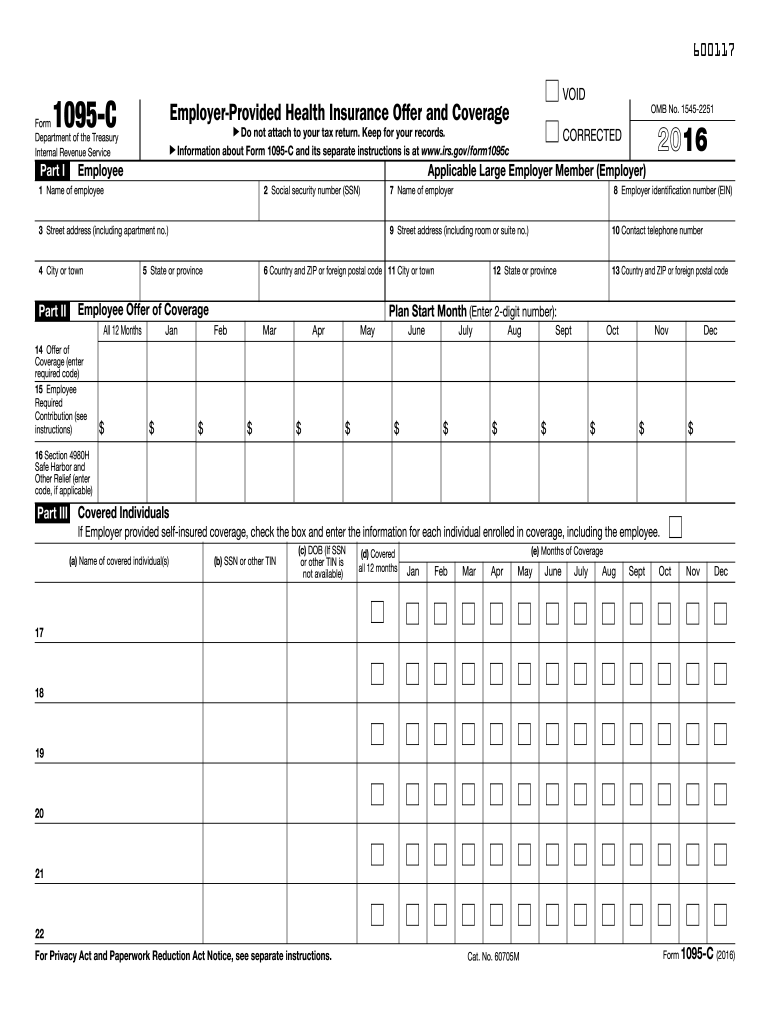

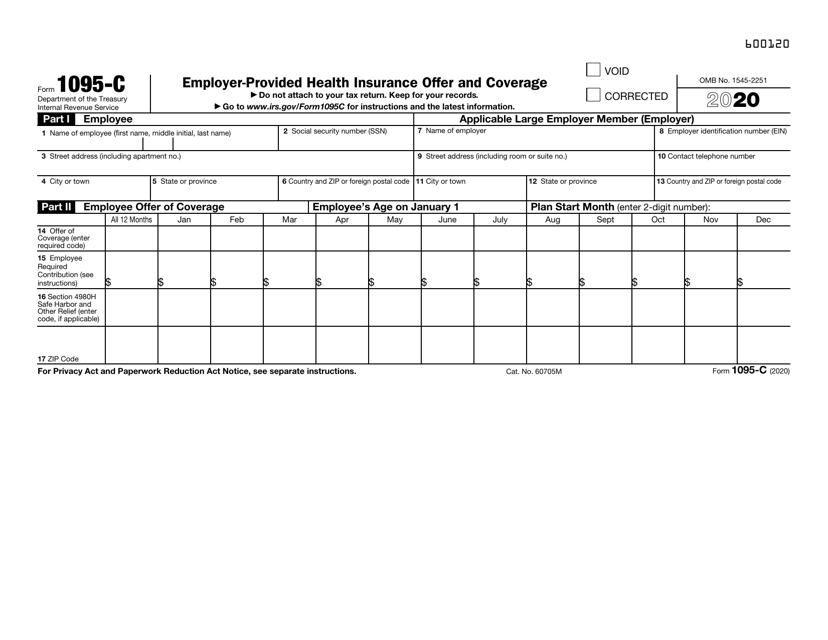

Example of 1095-c form filled out

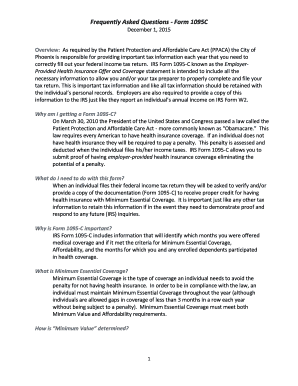

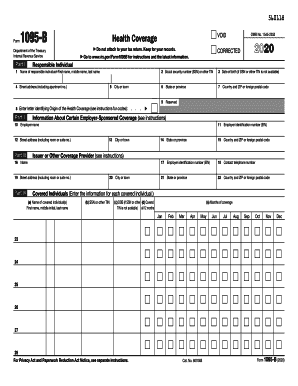

Example of 1095-c form filled out-Answer You should complete Part III of 1095C ONLY if the employer offers employersponsored selfinsured health coverage in which the employee or other individual enrolled For this purpose, employersponsored selfinsured health coverage does not include coverage under a multiemployer plan So you would not need to fill out this part of the formYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part

Control Files And Sample Forms

6/5/19 · Unfortunately, it is perfectly possible for a taxpayer to have employersponsored insurance (the 1095C) and marketplace insurance (the 1095A) at the same time, often because the taxpayer did not realize that his/her parents or other relation put the taxpayer on the policy as a favor If the IRS has you on that list (because it was reported toLet's Look At The Most Common 1095C Coverage Scenarios9/15/ · How to Fill Out (and File) Schedule C for Form 1040 Sole proprietorships and singlemember LLCs file Schedule C to report business net profit or loss Follow these 9 steps to filling out

1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a monthIn cases where the employer is selfinsured, the employer rather than the insurance company will send out the 1095B and it may appear in a combined form with Form 1095C Although the Shared Responsibility Payment (or penalty) has been eliminated by the Tax Cuts and Jobs Act starting with the tax year 19, employees will continue to receive3/2/21 · The IRS extended the deadline to provide employees with copies of their 1095C or 1095B health coverage reporting forms from Jan 31 to

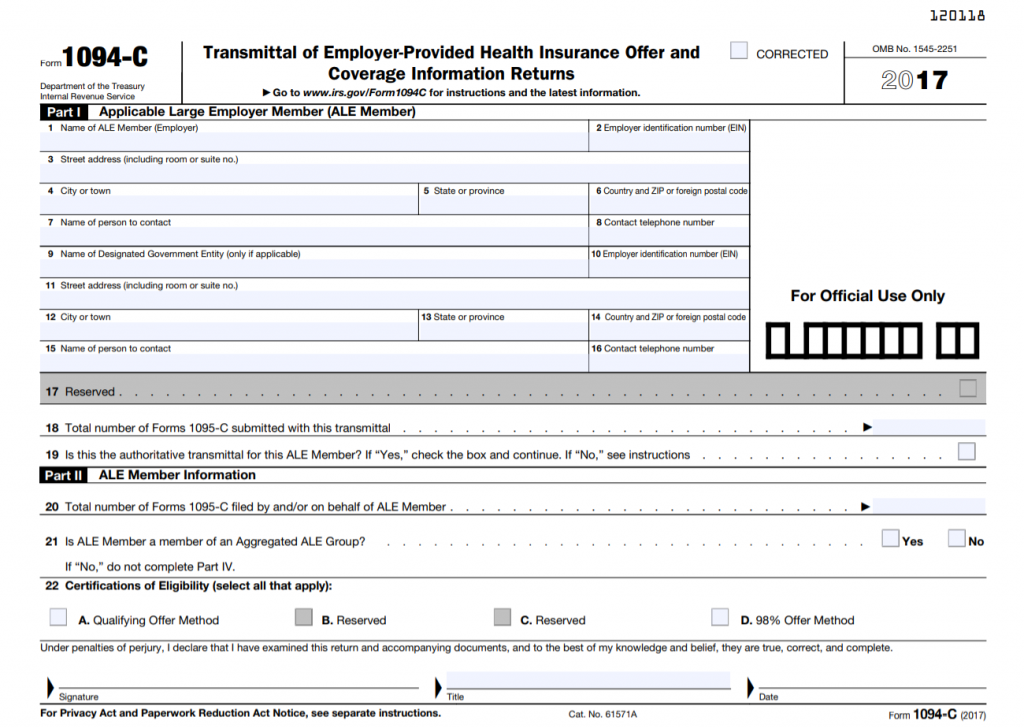

· Line 18 Because the 1094C is like a cover sheet for the 1095C, you calculate how many total 1095Cs you are submitting with this specific cover sheet and put that number here Line 19 When you fill out this form, determine whether you have all of the corresponding 1095Cs attached If yes, check this box · On October 15, the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicityNever done a 62 form, I need help filling it out I wish turbo tax hadn't done this change where almost no one saw where to input your 1095A

How Can I Get My Health Insurance Tax Form Picshealth

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

1/18/15 · Generally speaking, you may need a 1095 form to fill out your Form 1040, US Individual Income Tax Return, your Premium Tax Credit form 62, your Form 65, Health Coverage Exemptions, and to fill out the worksheet for figuring out your Shared Responsibility Payment on the Form 65, Health Coverage Exemptions Instructions in years it is applicableForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees1/21/16 · C Governmentsponsoœd program D Individual market insurance E Multiemployer plan F Other designated minimum coverage TIP If you or anotherfamily member received health insurance coverage throu a Health Insurance also known as an covera will be reporte on a orm rather than a Form 1095åe Line 9 This line will be blank for 15

Irs Form 1095 C The Best Way To Fill It Out

Tax Forms Bfi Printing Mailing Services Inc

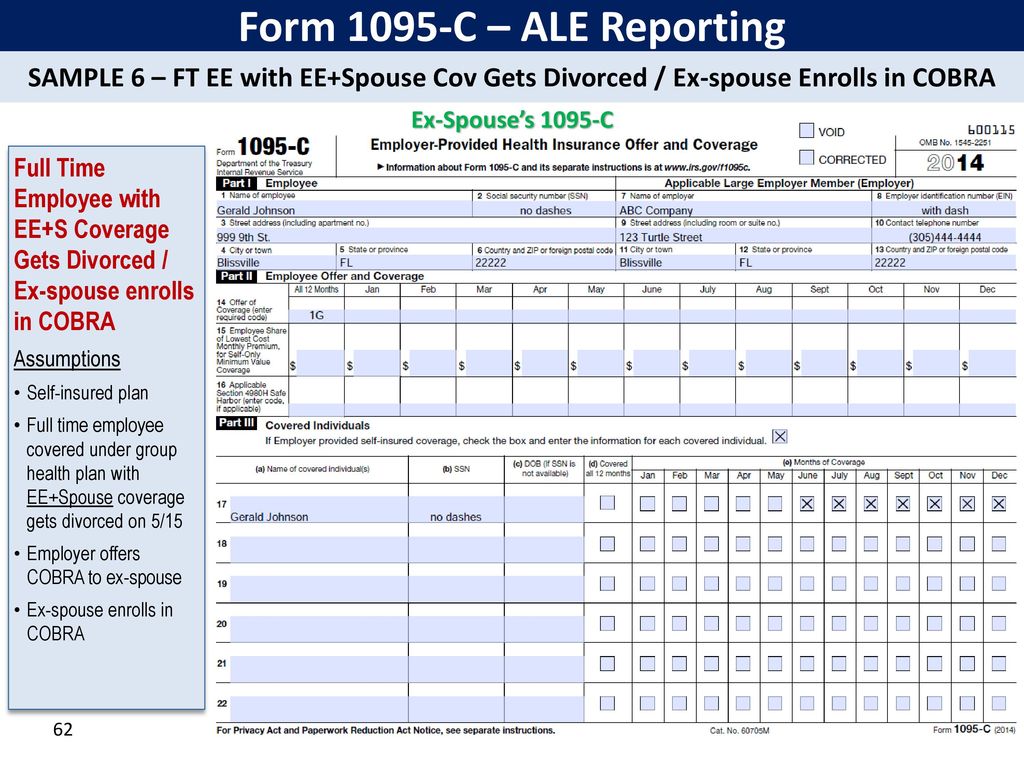

3/18/21 · Form 1095A is a document Americans need to if they buy health insurance through the government health insurance marketplaces established by the Affordable Care Act (commonly known as Obamacare) This is not a form you will actually fill out yourself — rather, you will get it from the healthcare exchange you use after your purchase is complete, and from there you will1/21/16 · Sample IRS Form 1095B Associated Files SampleForm1095Bpdf Sample IRS Form 1095B PDF • 257 KB Download Details Sample IRS Form 1095B This resource is related to Medical Assistance;3/9/15 · The webinar refers to the use of form 1095C as being optional for 6055 reporting for COBRA/retiree individuals by selfinsured employers, as forms 1094 and 1095B can also be used for this purpose Visit the IRSgov for more information on COBRA retiree reporting and eligibility

Form 1095 C The Aca Times

Ez1095 Software How To Print Form 1095 C And 1094 C

9/30/18 · In March, you will receive your 1095C form The form can also be used to complete a person's tax return He recalled that an FTA member should only be interested 1 type of health form is a health tax Next calendar year, you may need to complete both your personal tax return 1095c information to prepare the tax returnNo Form 1095C need be filed for 16 since employee not a fulltime employee B) If employee averaged 30 hours or more during the measurement period, the employee must be offered coverage for the succeeding stability period Assuming the employee enrolls in that coverage, Lines 14 16 of Form 1095C would be completed as follows3/10/21 · Now that that's out of the way, how does this play a part in filing the Form 1095C?

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

Accurate 1095 C Forms Reporting A Primer Integrity Data

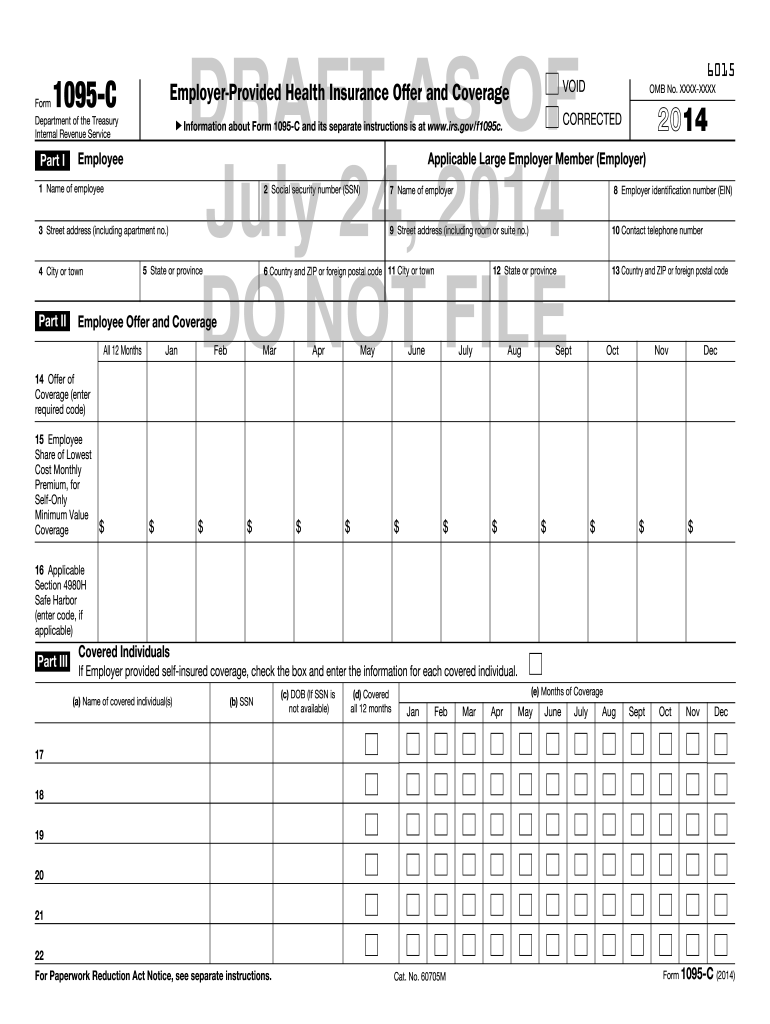

3/12/15 · A An employer that is eligible for the Qualifying Offer Method Transition Relief for any employee who receives a Qualifying Offer for all 12 months of the calendar year may, in lieu of furnishing the employee a copy of Form 1095C, furnish a statement as described in "Alternative Method of Furnishing to Employees Under the Qualifying Offer Method" section in the 1094 and 1095C2/15/18 · The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information1/4/19 · USCIS provides this flowchart showing the timing for the I9 form to be completed 2 Download Instructions on How to Fill Out the I9 Form Because the government updates forms annually, it's best to obtain the current I9 form and instructions directly from the USCIS website The form is free, and it can be downloaded as a fillable PDF form or a printable, fillinthe

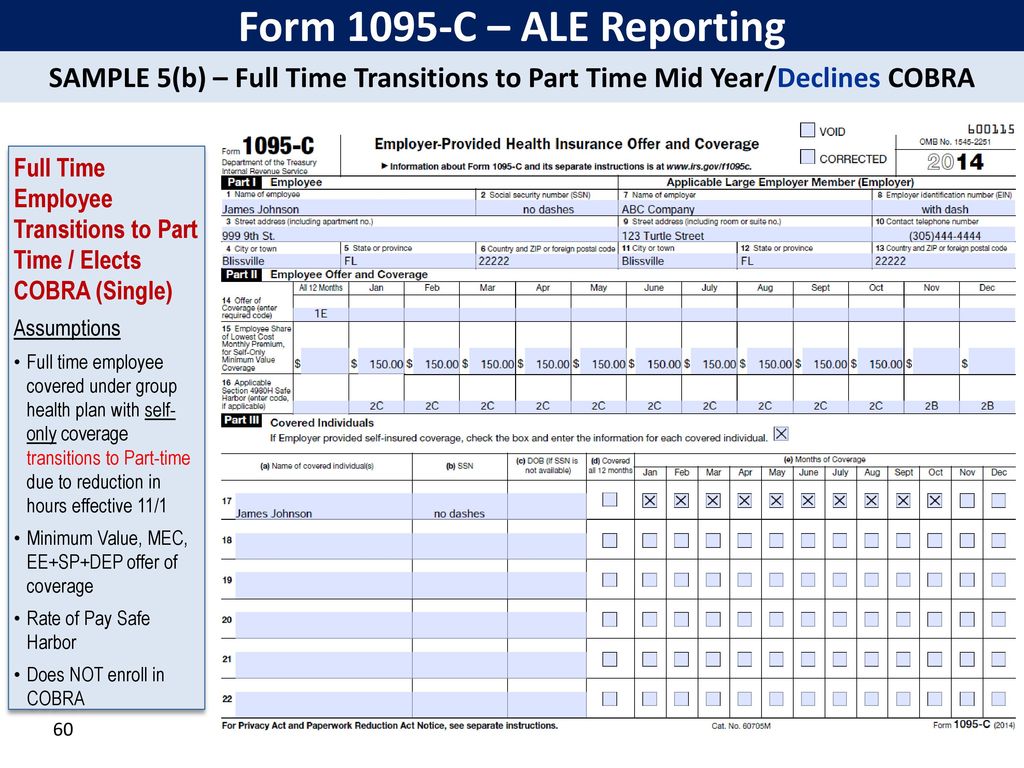

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Irs 1094 C Form Pdffiller

6/8/19 · I submitted my taxes through turbo tax without putting in my 1095A form info Received letter from IRS to send a completed form 62 and a copy of my 1095A Aren't the two forms about the same thing?4//16 · You'll send 1094C and 1095C to the IRS, and you'll also give a personalized copy of the 1095C to every single person on your team 3 Which brings us to the next point — there's a good reason for you to fill them out The entire reason these forms exist is to show the IRS that you're providing your team with meaningful health careFill out a PDF sample here, make needed edits, sign it and send instantly 21 1095c Template 21 1095c Template Form 1095C Get You may print out the Form 1095C and fill it out by hand Then make two copies to submit to your local IRS agency and to the employee

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

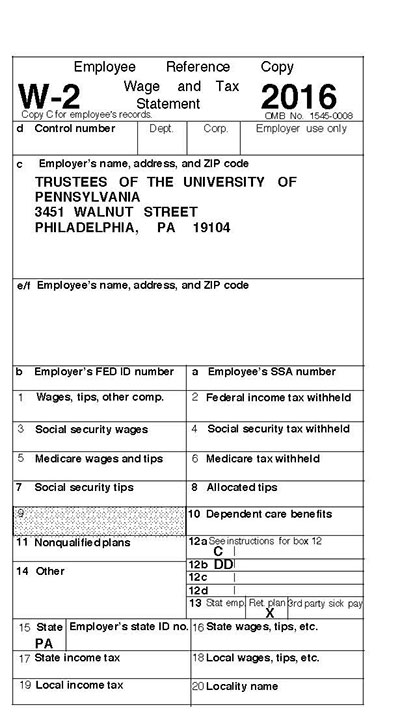

Tax Forms For 16 University Of Pennsylvania Almanac

1/7/21 · Step 1 Go to the Internal Revenue Service Website and download a copy of the IRS Form 1095C with the filling instructions Open it with PDFelement and start filling it out using the program Step 2 Begin filling Part IEmployeeYour family* may have received multiple Forms 1095A Health Insurance Marketplace Statements However, there are only certain instances in which the combined amounts from Column B of those forms should be transferred to the Monthly Calculation section (Lines 1223) of the Form 62 Premium Tax Credit (PTC)Form 1095A, Columns A and C will always be combined when transferred to FormLine 16 Codes of Form 1095C, Safe Harbor IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability Click here to learn more about ACA Form 1095C Line 16 Codes

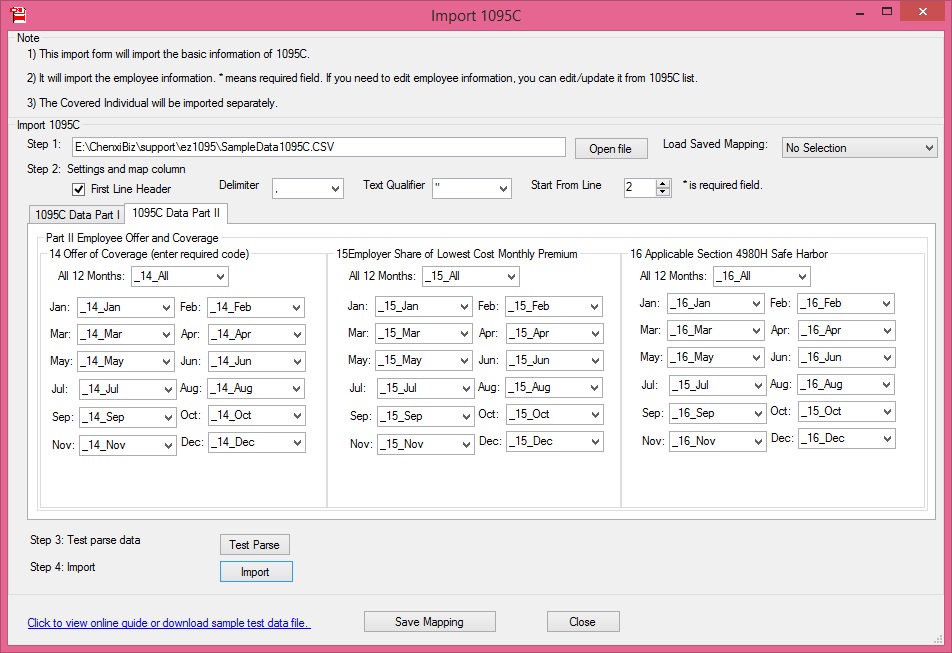

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Fillable Online Employee Phoenix Sample 1095 C Form Employee Phoenix Fax Email Print Pdffiller

1095c examples Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Turn them into templates for multiple use, add fillable fields to gather recipients?11/6/ · Form 1095C is a tax form reporting information about an employee's health coverage offered by an Applicable Large Employer The taxpayer does not fill out the form and does not file it with a tax return You only need to keep it for the records You May Also Read About IRS FormData, put and ask for legallybinding electronic signatures Do the job from any gadget and share docs by email or fax Check out now!

Import 1095 C Data With Expressirsforms Custom Template

Common 1095 C Coverage Scenarios With Examples Boomtax

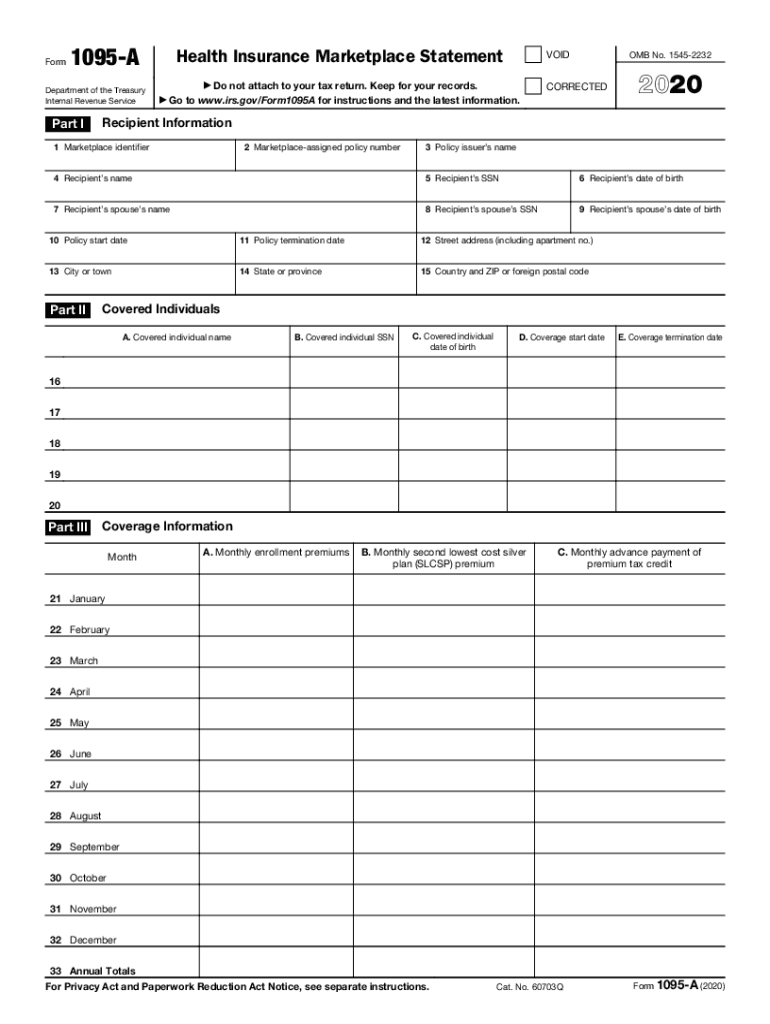

Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax creditHow to Read Form 1095C The actual form is broken up into three parts The employee information and the Applicable Large Employer Member information The employee offer and coverage section, which shows any costsLast updated Jan 21, 16 First published Jan 21, 16 Share this page Facebook;

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

12/30/15 · Line is the total number of 1095C forms that are being filed with this form This includes any 1095C's that are being filed on behalf of the employer Line 21, check YES if on any month of the previous calendar year, you were a member of an aggregated ALE, if you check NO, don't complete part 4 Line 22 gets a little more complicated If you fill out the form regularly, · If multiple Forms 1094C are being filed for an employer so that Forms 1095C for all fulltime employees of the employer are not attached to a single Form 1094C transmittal (because Forms 1095C for some fulltime employees of the employer are being transmitted separately), one of the Forms 1094C must report aggregate employerlevel data for2/18/21 · 1095C – This form is used by fullyinsured and selfinsured ALEs to report information about the health plan coverage they offered to employees Selfinsured employers will fill out the form differently than those who are fully insured Fulltime employee enrolled in

1094 B 1095 B Software 599 1095 B Software

How To Fill Out Form 62 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

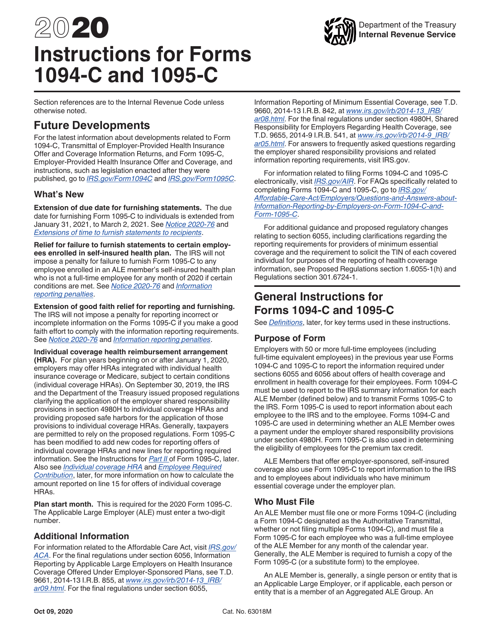

10/3/18 · Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 183/16/ · If you enrolled in a qualified health plan through the health insurance marketplace, however, you will receive Form 1095A If, on the other hand, you were offered or received minimum health care from an employer with at least 50 employees, you may receive Form 1095C instead of, or in addition to, Form 1095BForm 1095C is used by qualifying employers with 50 or more fulltime employees (including fulltime equivalents) that are subject to the employer responsibility provisions of the ACA Form 1095C contains information about the offer of health insurance coverage to employees and their

Form 1095 A 1095 B 1095 C And Instructions

Sample 1095 C Forms Aca Track Support

2/5/18 · No need to file a request for a "corrected" form or fill out any complicated paperwork (thank goodness) Forget about "Form 62, Part II" from the 1095A instructions, and instead hop on over to this helpful page of Healthcaregov (why they don't just say this in those instructions, I'll never know) Healthcaregov Health CoverageYou have to send the IRS one Form 1094C and one Form 1095C for each employee Part I This section of the Form 1094C relays the employer's name, employer identification number (if you don't have one, you can apply online), address, name, and point of contact This is also where you accurately record the number of employee Form 1095C filings you're submitting along with this form(Part I Employee) Complete a form 1095C for each person you employed fulltime for at least a month during the past year—and for any nonfulltime employees who enrolled in health insurance through your company Boxes 713 Make sure your employer name, EIN, and address match lines 16 on Form 1094C

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Control Files And Sample Forms

4/14/16 · If the Form 1095C has been filed with the IRS, a new, fullycompleted Form 1095C with the correct information must be submitted An "X" entered in the CORRECTED checkbox on the form The Form 1094C transmittal (not marked corrected) with the corrected 1095C forms must be filed with the IRS, and the employee must receive a copy of the2/3/15 · Ensure you put the ALEM that employs the particular person for which you are completing the Form 1095C In the example above, if you are filling in Bob's House of Widgets, you are doing it wrong 94 95 Next, you need to fill out your EIN on Line 8 Verify that the name that appears on Line 8 here matches the name and EIN provided on the1095 A Form Fill out, securely sign, print or email your 1095 A 17 Form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a

Benefits 1095 C

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

2/24/ · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Printable And Fileable Form 1099 Misc For Tax Year 17 This Form Is Filed By April 15 18 Fillable Forms Irs Forms 1099 Tax Form

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

1095 C Print Mail s

Sample 1095 C Forms Aca Track Support

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Irs Form 62 Calculate Your Premium Tax Credit Ptc Smartasset

Sample 1095 C Forms Aca Track Support

Ez1095 Software Speeds Up 1095 C Filing With Quick Data Uploading Feature Newswire

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Sample 1095 C Forms Aca Track Support

Aca Code Cheatsheet

Guide To Prepare Irs Aca Form 1095 B Form 1095 B Step By Step Instructions

What Payroll Information Prints On Form 1095 C To Employees

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Form 1095 C Guide For Employees Contact Us

Sample Of 1095 C

Form 1095 A 1095 B 1095 C And Instructions

Ez1095 Software How To Correct 1095 C And 1094 C Form

Payroll 1095 C Information Affordable Care Act Aca

1095 C Sample Hcm 401 K Human Resources

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1095 C Eemployers Solutions Inc

Print And Fill In 1095 C Fillable Form In 100 Free Cocosign

Control Files And Sample Forms

Sample 1095 C Forms Aca Track Support

1094 C 1095 C Software 599 1095 C Software

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Annual Health Care Coverage Statements

1094 C 1095 C Software 599 1095 C Software

Can An Employee Decline Health Insurance Gusto

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Updated Sample Employee Letters For Irs Forms 1095 B And 1095 C Kistler Tiffany Benefits

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Irs Form 1095 C Fauquier County Va

Free 1095 C Resource Employee Faqs Yarber Creative

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

1095 C Form Official Irs Version Discount Tax Forms

Accurate 1095 C Forms Reporting A Primer Integrity Data

Sample Print Of 1095 B And 1095 C 1095 Software

Think 14 Tax Forms Are Bad Here Come The 1094 And 1095 For 15 Aeis Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Aca Reporting Penalties Abd Insurance Financial Services

Aca Reporting Tip 16 Line 16 Union Employees Usi Insurance Services

Form 1095 A 1095 B 1095 C And Instructions

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Questions Employees Might Ask About 1095 C Forms Bernieportal

Form 1095 C Forms Human Resources Vanderbilt University

Irs Form 62 Calculate Your Premium Tax Credit Ptc Smartasset

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Control Tables And Sample Forms

No comments:

Post a Comment